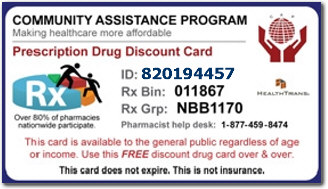

Get a FREE Rx Discount Drug Card - Offered by the National Community Assistance Program

Create and print your FREE discount prescription drug card.

This card will provide you with Rx health care savings of up to 55% at pharmacies across the country including Target, Cub Pharmacy, Kmart Pharmacy, CVS/pharmacy, Hy-Vee, Pamida, Shopko, Walgreens, Thrifty White, Walmart, and many more. This card is pre-activated and can be used immediately!

How to Qualify?

That would include anyone whose Social Security benefits before the part B premium deduction was $1153 or less: $1153 less $20 any-income deduction = $1133 countable income. Or If your countable income is more than $1133, you can reduce your countable income down to $1133 or below by purchasing health insurance.

What happened? Why did my Medi-Cal Share of Cost go up?

When the IHSS share of cost people were transferred to Medi-Cal in 1998, the State paid the difference between the Medi-Cal and IHSS share of cost so that people who did not qualify for Medi-Cal under other programs would continue to have the same amount to live on as those who receive SSI/SSP and because IHSS recipients, unlike most of those who qualified for Medi-Cal with a share of cost, have to pay their share of cost each and every month.

Determining countable earned income?

Different rules apply when determining countable earned income. If you earned $1200 before any deductions or taxes, your countable earned income would be $557.50: $1200 less $20 any-income deduction less $65 earned income deduction = $1115 les 50% or $557.50 = $557.50. If you have both earned and unearned income, you can use the $20 any-income deduction only once.

What is Share of Cost

This is called �meeting your share of cost.� Your Share of Cost is a set amount based on how much money you make. Medicare, Medicaid assistance.

Get Your Share of Cost Threshold with Dental Insurance

Compare share of cost with dental insurance in the following states: Alabama, Alaska, Arizona Health Care Cost Containment System, Arkansas, California Medi-Cal, Colorado Office of Medical Assistance, Connecticut Social Services, Delaware Health and Social Services, Florida Agency for Health Care Administration, Georgia Community Health, Hawaii Med-QUEST Division, Idaho Health and Welfare, Illinois Health and Family, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada Medicaid Check Up Program, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

After you meet your share of cost state assistance pays for your care the rest of that month.

What is countable income?

Countable Income

Calculation (Medi-Cal)

The formula used to determine income and to consider eligibility for SSI-Linked, Medically Needy, and Aged and Disabled Medi-Cal

programs.

Step 1: If you have unearned income (for example, an SSDI benefit),

subtract a $20 "General Income Exclusion" from it to calculate your

countable unearned income. If you do not have unearned income, this

exclusion is applied to any earned income.

Step 2: If you have earned income (for example, wages), subtract a

$65 "Earned Income Exclusion" from it (along with the remainder of

the $20 "General Income Exclusion" that you have not applied to

Unearned Income), along with any Impairment Related Work Expenses,

and divide the resulting figure by two to find your countable earned

income. If you have Blind Work Expenses, subtract them after you

divide by two.

Step 3: Add your countable unearned income to your countable earned

income to find your total countable income.

Different Medi-Cal programs may include more deductions or exclude

certain types of income. See the program descriptions for details.

Aged & Disabled Federal Poverty Level Medi-Cal

(A&D FPL)

If you are aged or disabled, and are not eligible for SSI, you may

be able to get Medi-Cal through the Aged & Disabled Federal Poverty

Level (A&D FPL) program. You must:

Be either aged (65+), or disabled (meet Social Security�s definition

of disability, even if your disability is blindness)

Have less than $2,000 in assets ($3,000 for a couple). Like SSI,

this program does not count all of your assets.

Click here for a

list of exemptions.

Have less than $1,211 in countable monthly income for an individual

($1,638 for a couple).

211 Program